CLOSE

Welcome to the exciting world of trading! Whether you’re a seasoned trader or just dipping your toes into the market, finding reliable indicators is essential for making profitable trades. One such indicator that has gained popularity among traders is the Buysell Indicator. With its ability to provide valuable insights into market trends and potential entry and exit points, configuring this indicator with confidence can be the key to unlocking successful trades.

The Buysell Indicator is a powerful tool that can provide valuable insights into market dynamics and help traders make informed decisions. But before we dive into configuring it, let’s first understand how this indicator works.

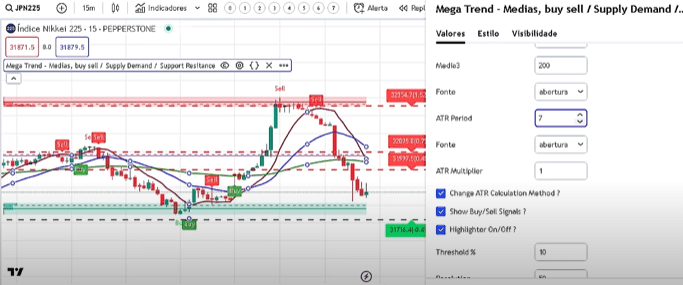

At its core, the Buysell Indicator analyzes price movements and trends to identify potential buying or selling opportunities in the market. It uses various technical analysis tools like moving averages, support and resistance levels, and momentum oscillators to generate signals.

When the indicator detects a bullish trend forming, it generates a “buy” signal indicating that it may be an opportune time to enter a trade. On the other hand, when a bearish trend is identified, a “sell” signal is generated suggesting that it might be wise to consider exiting or shorting a position.

Configuring the Buysell Indicator for optimal results is essential to maximize your chances of profitable trades. By understanding how to set it up correctly, you can gain a competitive edge in the market.

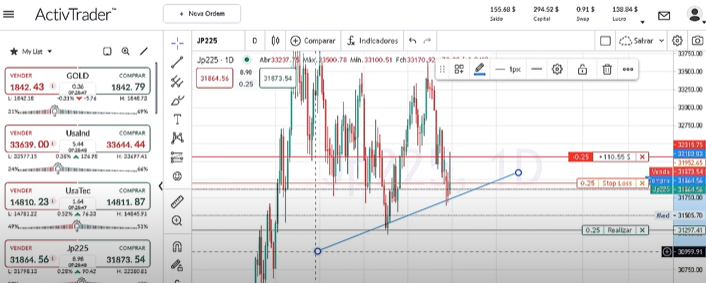

It’s crucial to determine the time frame that best suits your trading strategy. The Buysell Indicator allows you to choose from various time frames such as hourly, daily, or weekly. Consider factors like your risk tolerance and preferred holding period when making this decision.

Next, pay attention to the indicator’s parameters. These include settings such as sensitivity and threshold levels. Adjusting these parameters can help filter out noise and provide more accurate signals. It may take some experimentation before finding the right settings that align with your trading style.

When using the Buysell Indicator for your trades, there are several key factors that you need to consider in order to maximize your success. These factors will help you make more informed decisions and increase your chances of profitable trades.

It is important to understand that the Buysell Indicator is just one tool in your trading arsenal. It should not be used as the sole basis for making trading decisions. Instead, it should be used in conjunction with other technical analysis tools and indicators to confirm signals and identify trends.

Successfully configuring the Buysell Indicator is a crucial step towards achieving profitable trades. By understanding its functionality and making the right adjustments, traders can gain confidence in their trading decisions. The Buysell Indicator provides valuable insights into market trends, helping traders identify potential entry and exit points.