CLOSE

Navigating the world of taxes can feel like a maze, but understanding the W4 form is crucial for anyone who earns an income. This document directly impacts how much tax is withheld from your paycheck, influencing your take-home pay. With THE LIONZ SHARE™ by your side, you’ll gain clarity and confidence in completing this essential task. Let’s dive into everything you need to know about filling out that W4 with ease!

The W4 form is an essential document for employees. It informs your employer how much federal income tax to withhold from your paycheck. Completing it accurately can help you avoid owing money at tax time or getting a large refund.

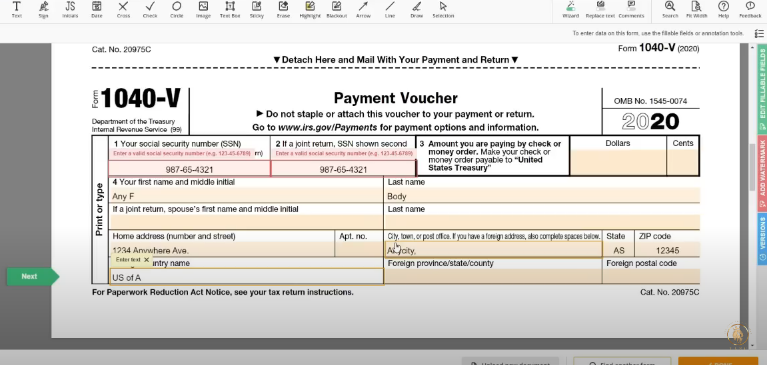

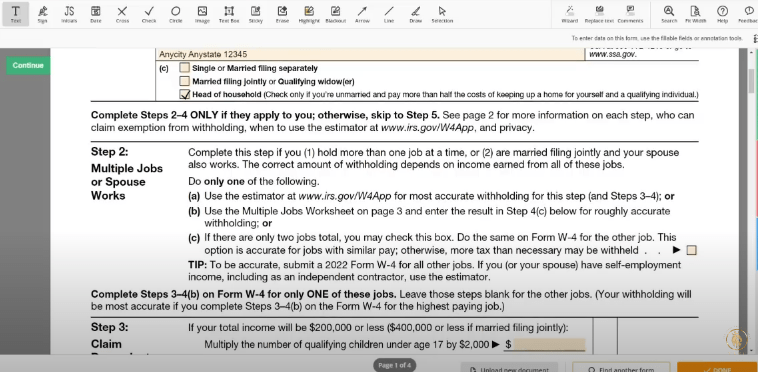

Filling out the W4 form accurately is crucial for managing your tax withholdings. Start by providing your personal information, such as name, address, and Social Security number. This ensures that the IRS can properly identify you.

Once you’ve filled out the W4 form, it’s time to submit it. Hand it directly to your employer or HR department. Make sure they keep a copy for their records.

After submission, monitor your paychecks for any changes in withholding amounts. Adjustments may take a pay cycle or two to reflect. If you notice discrepancies, don’t hesitate to reach out to payroll for clarification or further adjustments as needed.

Navigating the W4 form doesn’t have to be daunting. By understanding its purpose and following a clear process, you can ensure your tax withholding is accurate. This not only helps in avoiding surprises during tax season but also ensures that you’re making the most of your earnings throughout the year.Stay informed about any changes to tax laws that may affect you moving forward. Embracing resources like THE LIONZ SHARE™ can guide you further on financial matters beyond just the W4 form.